The Time Value of Money and the Energy Efficient Mortgage

Let me ask you a question: Would you rather I gave you $100 one year from now or $100 right now? No brainer; it’s easy to see that $100 right now is worth more than $100 in the future. Another way to say that is $100 in future value is worth less than $100 in present value. But what if I told you that I’d give you $100 one year from now or $90 today? Which would you take?

Let me ask you a question: Would you rather I gave you $100 one year from now or $100 right now? No brainer; it’s easy to see that $100 right now is worth more than $100 in the future. Another way to say that is $100 in future value is worth less than $100 in present value. But what if I told you that I’d give you $100 one year from now or $90 today? Which would you take?

Let me ask you a question: Would you rather I gave you $100 one year from now or $100 right now? No brainer; it’s easy to see that $100 right now is worth more than $100 in the future. Another way to say that is $100 in future value is worth less than $100 in present value. But what if I told you that I’d give you $100 one year from now or $90 today? Which would you take?

As it turns out, financial analysts, those other folks who like numbers, have figured out how to calculate the breakeven point. You can tell them a future value number, and they’ve got a formula you can use to calculate how much it’s worth in today’s dollars, the present value. They just need two other numbers to figure it out: the interest rate and the period of time involved.

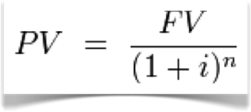

Here’s the forumula:

If I give you $100 in one year (n = 1), and the interest rate, i, at which you could have invested that $100 now is say, 3%, your present value would be $100 /(1+0.03)^1 = $97.09. You can change the interest rate and the amount of time and see how the present value varies.

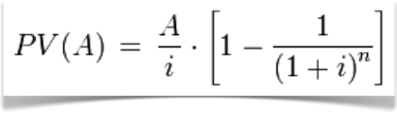

What happens, though, if it’s not just a single payment that you get in one year? Let’s say you’re going to get $100 every year. Those crafty financial guys have that one figured out, too.

Cool! The only new variable here is A, which was called FV in the other formula. You’re summing up the annual payments for a given number of years, n, and finding the cumulative present value due to all those payments.

But what’s it good for?

The Energy Efficient Mortgage (EEM) and present value

The HERS Standards discuss present value (as well as another cost effectiveness measure called Savings Investment Ratio, or SIR) in chapter 3, the technical standard. This is because home energy ratings exist mainly because of the effort to give credit to buyers of energy efficient homes for the savings they realize. The HERS Standards (download pdf) are titled, Mortgage Industry National Home Energy Rating Systems Standards, after all.

This present value calculation is enormously important for the Energy Efficient Mortgage, which has many benefits. In fact, when you look at the numbers, it’s really baffling that these things aren’t being written in huge numbers every month. (You can download the slides from a webinar I did with Jason Payne of EEM Training in 2011 to learn much more about how they work and see a powerful case study.)

Anyway, to get an EEM to improve an existing home (sometimes called an Energy Improvement Mortgage, or EIM), the HERS rater finds the present value of the energy savings due to improvements they model. Then they compare two numbers: the present value and the cost of the improvements.

Net Present Value = Present Value – Cost of Improvements

This equation tells you how much of your future money you can spend now without going in the hole. If the result is a positive number, the modeled improvements are deemed to be cost effective and can be included in the loan amount for an EEM (within the bounds of the EEM guidelines, of course). As long as your net present value is zero or positive, you’re at least breaking even.

If you’re like me, when lenders start talking, your eyes glaze over and they seem to be talking alienese. If they talk about present value, though, it’s really a pretty simple concept. An important one, too. If you’re looking to buy a home or refinance the home you’re in, you really ought to check out whether an EEM makes sense for you. It’s not that hard to have a positive net present value with older homes.

To learn more about present value and EEMs, download our webinar slides.

Related Articles

What’s the Payback on Home Energy Efficiency?

10 Things You Should Know about the Energy Efficient Mortgage

Why Is the Energy Improvement Mortgage So Lonely?

Photo by TheAlieness GiselaGiardino²³ from flickr.com, used under a Creative Commons license.

This Post Has 4 Comments

Comments are closed.

EEMs/EIMs get far too little

EEMs/EIMs get far too little attention! And unfortunately BANKS are some of the most ignorant folks around when it comes to these progressive types of mortgages. Appraisers are the other side of this challenge – for if your super-insulated home does not appraise for any more than the cheap stick-built/fiberglass home that is identical in every other fashion, most banks will make short work of you and laugh at your claims for having a superior home – “Hey buddy, they appraised for the same value”. It’s a frustrating process, but hopefully with more education and more open-mindedness all around it can advance.

And of course another problem can be when you have multiple home energy improvement initiatives, to which do you ascribe your projected savings for projections of ROI (Return on Investment)?

KEY POINT that many – even the “smart folks” – forget, if you are building a home anyway, the focus for the ROI calculation should be on the PREMIUM associated with the investment alternative, NOT the basis. Understand? Sorry I digress off of the basic EEM article (which is a good one), but simply lots of ignorance out there about how to approach this.

Also most banks will not consider the long term historic trends of increasing costs of energy in their FV calculations.

So, why then do so few people

So, why then do so few people actually do EEMs? Last year there were fewer than 1000 for the entire country, and every year there seem to be less than the year before.

I think it is simple math and comes back to how folks make money. The average EEM last year added only $7,500 per mortgage. When you translate that to how a broker or agent gets paid… 6% to agents, 3% to each side, split that 50/50 with the house, and you end up with a payday to each of the key folks in the transaction of $112.50 each.

Considering how an EEM extends the transaction time, adds extra steps, and of course can potentially blow a deal (I have experience personally sinking a sale by finding asbestos ducts)…. it is pretty clear that the economics just don’t really work.

I think we need to start by making EEMs profitable to those folks who really make these deals happen… and until we do that, they will never fly.

2 Q’s here: 1) Does the

2 Q’s here: 1) Does the consumer have to implement the most cost effective EE upgrades you recommend as the HERS Rater or can they select any package of EE measures as long as they show net present value higher than the installed cost? 2) If the HERS Rater suggests air sealing or duct sealing (which they almost always do) does the EIM require that the HERS Rater come back to re-test? (this adds cost to consumer). Lastly, a statement: My experience is that most homeowners/lenders are interested in EIM’s for one thing: new windows. More often than not new windows aren’t shown to be cost effective (at least in my climate) through NPV calcs. This is hard to explain to the consumer/lender. I can’t tell you how many times I’ve heard, “I just want new windows” regardless of what I recommend.

Good article, Allison. NPV

Good article, Allison. NPV is a great metric if you understand it. Thanks for making this topic easy to understand. However, ‘i’ is more accurately described as the discount rate – very often ‘i’ is set to the prevailing investment rate or inflation rate. The discount rate chosen has a large impact on the outcome. Therefore, it is often a point of contention. Dave Roberts has written a great article on discount rates (with Otters!) Check it out:

http://grist.org/article/discount-rates-a-boring-thing-you-should-know-about-with-otters/