Electricity Demand and the Duck Curve

You may think there’s no more boring topic than electric utilities. Power plants. Transmission lines. Engineers with flat top haircuts and pocket protectors full of pens in their white short-sleeved shirts. Well, let me say two words that might help make them more interesting to you: duck curve. If you haven’t heard this term yet, you’re not alone.

A primer on utility load curves

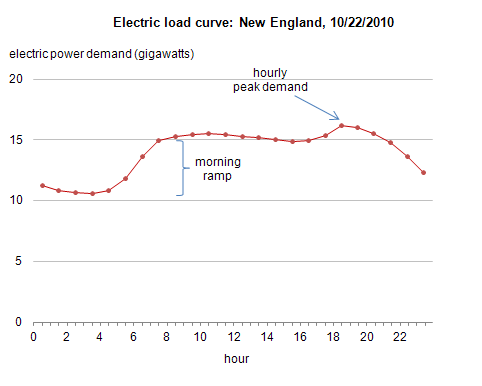

The graph below shows a typical daily load profile for an electric utility. This one’s for a day in New England in 2010, but the basic pattern is clear. Demand for electricity is at its lowest during the night. When people wake up and start their day, demand rises (morning ramp). Then it stays up at a higher level through the day but rises to a peak after work ends and everyone returns home.

That’s what a typical day looks like in a lot of places. In addition, there are annual changes and utilities are often classified as either summer peaking or winter peaking. That’s just what you think: which season the utility hits its highest peak load for the year.

Utilities meet that demand in two ways. They have baseload plants and peaking plants. Baseload plants are mostly coal-fired here in the Southeast and mostly hydro in the Northwest. Peaking plants are often fueled by natural gas.

Now, what electric utility companies would like their load curve to look like is shown below. If the demand were perfectly flat, a utility’s job would become trivial. (Of course, there’s all that messy stuff about storms and growth and plant outages, but let’s ignore that here.) Push the button and let the generating plants run to deliver that unchanging amount of electricity. They could meet all the load with cheaper electricity from baseload plants and never have to turn on the peaking plants.

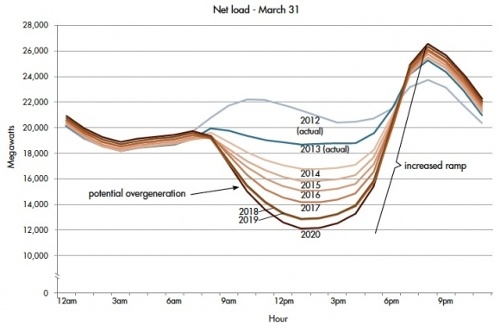

But things are changing, and quickly. California seems to be experiencing it first, but it’s likely to hit other states, too. What’s happening is that cheap photovoltaic modules (a.k.a, solar panels, although that’s ambiguous) are reducing the demand during the sunny part of the day. The morning ramp is flattening out, and now the evening ramp is getting steeper. The chart below shows the trend, actual and projected. (See Greentech Media for more on the duck curve.)

As you can see here, the load during the middle of the day gets smaller because of all the PV-generated electricity entering the grid. As that electricity starts dropping off in late afternoon and evening, the evening peak begins to hit. That means that utility power plants that had been resting during the PV-saturated afternoon hours suddenly need to ramp up quickly. As you know, any large-scale operation has trouble turning on a dime, so the duck’s neck in the evolving load profile presents problems.

The world of electricity generation is changing rapidly. From smart meters to microgrids to the Tesla Motors Powerwall, there’s a lot happening. The duck curve is an indicator.

Matt Golden, a policy guy in California who came from the home performance world, raised the issue of dramatic change in a comment on one of my LinkedIn articles. In it, he talked about the “new world where EE [energy efficiency] is dead.” (There’s more to it than meets the eye, though, so don’t rush to judgment here yet.)

Could that be true? Will the duck curve kill energy efficiency? Or instead, is it time “to declare hunting season on the Cal ISO’s duck chart,” as a retired California Public Utility Commissioner suggested.

I’ll be taking a deeper look into this issue next week, so be sure to check back then. (Or just put your email address in the box at the top of the page and you’ll get a notification when the article comes out.)

Allison A. Bailes III, PhD is a speaker, writer, building science consultant, and the founder of Energy Vanguard in Decatur, Georgia. He has a doctorate in physics and writes the Energy Vanguard Blog. He also has a book on building science coming out in the fall of 2022. You can follow him on Twitter at @EnergyVanguard.

Related Articles

Energy and Power and Confusion and Consternation

Solar Electricity: “The Final Source of Energy”

Photo of transmission lines by Chris Hunkeler from flickr.com, used under a Creative Commons license.

NOTE: Comments are closed.

This Post Has 42 Comments

Comments are closed.

Thanks Allison. As usual, I

Thanks Allison. As usual, I very much enjoy your articles and insights!

Good presentation. Following

Good presentation. Following one of your links I found a great discussion by the president of SDG&E on the matter http://www.greentechmedia.com/articles/read/Jim-Avery-on-the-Promise-of-EVs-and-the-Pitfalls-of-Solar and he points out that by financial incentives solar users may become the solution to this. ex: Make battery storage inexpensive enough, and all those homes go on battery in the evening, and the grid demand flattens. Personally, I see the grid becoming the emergency backup for solar users, and we will have to pay to support it, just as we do for Cloud disk backup. TANSTAAFL.

Allison, glad to see you

Allison, glad to see you bring this topic about the peaking (Peking?) Duck Curve to your blog. It’s an important topic that illustrates how Energy Efficiency will need to change its focus in the future. Yes, we still need to air-seal and insulate and keep doing what we do now, but we will also need to help clients develop strategies for storing electrical and thermal solar energy during the day for use in the evening.

In effect, we need to still use all of our ingredients for efficiency, but add several flavors of storage to shift the over-generation belly to the peaking evening load, and squash the duck’s head.

So, what ingredients do you see going into squashed duck soup? Tesla PowerWall, super-insulated hot water tanks, trombe walls, behavior changes, septic methane CHP systems, wind mills, industrial storage?

Plenty to discuss, thanks for opening up the topic.

Setting rigid pricing causes

Setting rigid pricing causes these perversions. A lot of utilities are effectively managing demand with demand response, how does that work?

Not by "asking" people to shift their use, but by paying them for it.

Right now there is absolutely NO reason for me not to plug my car in at 5pm AND turn my AC on. I might even do these things without compensation if it wasn’t inconvenient and I knew there was societal benefit, but there is no way of know if avoiding this behavior matters because there is no signal.

And a price signal would certainly motivate a larger group to respond.

Allow me to participate in the market for energy and I’ll shift when I charge my electric car. Make it attractive enough, I might also get a Tesla Energy storage system and sell into peaks.

Thanks Allison. As usual, I

Thanks Allison. As usual, I very much enjoy your articles and insights!

Roger that Ted and as

Roger that Ted and as renowned economist and Nobel Prize winner Homer Simpson is often heard to say, "It’s always about the money." .

Or maybe that was Paul Krugman…

And I think it was Bugs Bunny who said, "More carrots!".

I had to take a closer look at what, at first glance, appeared to be an odd looking Duck Curve in the text of Allison’s fine article. From my years with PEPCO in DC, a typical peak day curve looked considerably different and then I realized I was looking at California at the end of March.

It would be interesting to see the same graph with potential over generation (spare capacity?) superimposed upon a summer day although, no doubt the point has been made with the March presentation.

Good presentation. Following

Good presentation. Following one of your links I found a great discussion by the president of SDG&E on the matter http://www.greentechmedia.com/articles/read/Jim-Avery-on-the-Promise-of-EVs-and-the-Pitfalls-of-Solar and he points out that by financial incentives solar users may become the solution to this. ex: Make battery storage inexpensive enough, and all those homes go on battery in the evening, and the grid demand flattens. Personally, I see the grid becoming the emergency backup for solar users, and we will have to pay to support it, just as we do for Cloud disk backup. TANSTAAFL.

Allison, glad to see you

Allison, glad to see you bring this topic about the peaking (Peking?) Duck Curve to your blog. It’s an important topic that illustrates how Energy Efficiency will need to change its focus in the future. Yes, we still need to air-seal and insulate and keep doing what we do now, but we will also need to help clients develop strategies for storing electrical and thermal solar energy during the day for use in the evening.

In effect, we need to still use all of our ingredients for efficiency, but add several flavors of storage to shift the over-generation belly to the peaking evening load, and squash the duck’s head.

So, what ingredients do you see going into squashed duck soup? Tesla PowerWall, super-insulated hot water tanks, trombe walls, behavior changes, septic methane CHP systems, wind mills, industrial storage?

Plenty to discuss, thanks for opening up the topic.

Setting rigid pricing causes

Setting rigid pricing causes these perversions. A lot of utilities are effectively managing demand with demand response, how does that work?

Not by “asking” people to shift their use, but by paying them for it.

Right now there is absolutely NO reason for me not to plug my car in at 5pm AND turn my AC on. I might even do these things without compensation if it wasn’t inconvenient and I knew there was societal benefit, but there is no way of know if avoiding this behavior matters because there is no signal.

And a price signal would certainly motivate a larger group to respond.

Allow me to participate in the market for energy and I’ll shift when I charge my electric car. Make it attractive enough, I might also get a Tesla Energy storage system and sell into peaks.

Roger that Ted and as

Roger that Ted and as renowned economist and Nobel Prize winner Homer Simpson is often heard to say, “It’s always about the money.” .

Or maybe that was Paul Krugman…

And I think it was Bugs Bunny who said, “More carrots!”.

I had to take a closer look at what, at first glance, appeared to be an odd looking Duck Curve in the text of Allison’s fine article. From my years with PEPCO in DC, a typical peak day curve looked considerably different and then I realized I was looking at California at the end of March.

It would be interesting to see the same graph with potential over generation (spare capacity?) superimposed upon a summer day although, no doubt the point has been made with the March presentation.

Ted makes an excellent point

Ted makes an excellent point re: price signals. The problem is how to get from here to there.

Since retail energy is regulated at the state level, rate design decisions are more political than rational. In particular, no state is going to allow a utility to impose time-of-use or kW (demand) charges on residential customers. And while voluntary demand response tariffs have been around for decades, penetration rates are miniscule, and it’s well understood (and not at all surprising) that the customers who opt in are the ones who already have favorable load curves.

In order to get traction, a price signal must be mandatory. The problem is, state regulators are unwilling to go there since any truly effective rate structure is going to necessary create lots winners and losers. No politician wants to touch that. Why do you think highway use taxes have remained flat (and proceeds declining) for so many years?

Without an appropriate price signal, energy storage technologies have very limited appeal in the residential market. In that context, PowerWall is mostly as an expensive (and very limited) backup power system. Reporters who cover PowerWall (apparently) don’t understand that an existing grid-tied solar array can’t be integrated with a PowerWall. When the power goes out, once the initial battery charge is depleted you have to wait until grid power is restored to recharge. If the objective is to operate off-grid, then a different type of inverter is required, along with its own PV panels. Those panels do you no good during the 99.9% of the hours that the grid is up. New hybrid inverters and charge control systems are being developed, but one has to ask if it doesn’t make more sense to simply buy a backup generator.

Elon Musk is a smart man. He knows this. The only reason he’s giving lip service to the home market is because that’s the key to getting broad media placement. If he only talked about the real market for PowerWall (industrial & institutional), his media show would be relegated to trade rags.

Long term, it’s clear that TOU and demand rates are the future for rational rate design. That future will dramatically change what it means to design a high performance home, where energy storage and smart controls will trump envelope and equipment efficiency in terms of value. This becomes very apparent when you design the building systems for off-grid homes.

Oh, I should mention this…

Oh, I should mention this… Now we have a new problem. As many of you know, growing number of utilities are pushing back against rooftop solar by raising fixed charges and lowering energy charges. That’s dumb policy on several levels. It not only discourages both rooftop solar and energy efficiency but does nothing to improve the load shape. In fact, many of these same utilities are bound by law to meet renewable portfolio targets, and will continue doing so with utility-scale arrays. Grid-scale PV creates the same duck-curve as rooftop solar. So it’s clear this new pricing strategy is political rather than rational. Simply put, the utilities don’t want their customers to be in the generation business.

So to Matt’s point… yeah, if you have to pay $100/mo for the meter and only pay 4 cents per kWh for electricity, that sorta kills EE (and rooftop solar). That seems to be where we’re headed. But it doesn’t kill home performance and building science. Folks still want to be comfortable and have a healthy indoor environment, and a house that won’t rot.

Ted makes an excellent point

Ted makes an excellent point re: price signals. The problem is how to get from here to there.

Since retail energy is regulated at the state level, rate design decisions are more political than rational. In particular, no state is going to allow a utility to impose time-of-use or kW (demand) charges on residential customers. And while voluntary demand response tariffs have been around for decades, penetration rates are miniscule, and it’s well understood (and not at all surprising) that the customers who opt in are the ones who already have favorable load curves.

In order to get traction, a price signal must be mandatory. The problem is, state regulators are unwilling to go there since any truly effective rate structure is going to necessary create lots winners and losers. No politician wants to touch that. Why do you think highway use taxes have remained flat (and proceeds declining) for so many years?

Without an appropriate price signal, energy storage technologies have very limited appeal in the residential market. In that context, PowerWall is mostly as an expensive (and very limited) backup power system. Reporters who cover PowerWall (apparently) don’t understand that an existing grid-tied solar array can’t be integrated with a PowerWall. When the power goes out, once the initial battery charge is depleted you have to wait until grid power is restored to recharge. If the objective is to operate off-grid, then a different type of inverter is required, along with its own PV panels. Those panels do you no good during the 99.9% of the hours that the grid is up. New hybrid inverters and charge control systems are being developed, but one has to ask if it doesn’t make more sense to simply buy a backup generator.

Elon Musk is a smart man. He knows this. The only reason he’s giving lip service to the home market is because that’s the key to getting broad media placement. If he only talked about the real market for PowerWall (industrial & institutional), his media show would be relegated to trade rags.

Long term, it’s clear that TOU and demand rates are the future for rational rate design. That future will dramatically change what it means to design a high performance home, where energy storage and smart controls will trump envelope and equipment efficiency in terms of value. This becomes very apparent when you design the building systems for off-grid homes.

Oh, I should mention this…

Oh, I should mention this… Now we have a new problem. As many of you know, growing number of utilities are pushing back against rooftop solar by raising fixed charges and lowering energy charges. That’s dumb policy on several levels. It not only discourages both rooftop solar and energy efficiency but does nothing to improve the load shape. In fact, many of these same utilities are bound by law to meet renewable portfolio targets, and will continue doing so with utility-scale arrays. Grid-scale PV creates the same duck-curve as rooftop solar. So it’s clear this new pricing strategy is political rather than rational. Simply put, the utilities don’t want their customers to be in the generation business.

So to Matt’s point… yeah, if you have to pay $100/mo for the meter and only pay 4 cents per kWh for electricity, that sorta kills EE (and rooftop solar). That seems to be where we’re headed. But it doesn’t kill home performance and building science. Folks still want to be comfortable and have a healthy indoor environment, and a house that won’t rot.

Its already happening with

Its already happening with Natural gas and Water bills in our area. high fixed monthly charges with low energy costs. $30/mo base charge for NG, 37 cents per therm for the gas. The gas company sells the fuel at cost and makes all their profit from the fixed monthly fees. As you said, there is little incentive to conserve energy when your annual cost for fixed monthly fees exceeds your fuel cost.

I hear you Bob! My most

I hear you Bob! My most recent gas bill is $8 for fuel and $26 in charges for a total of $34. I probably can afford to pay for electricity to heat my water and home even at the higher cost per BTU when I consider eliminating the monthly gas base charges. I’m waiting for the next system (water or home heat) breakdown to change over. Unfortunately I maintain them, so they’re still going strong. 😉

Don’t be surprised when

Don’t be surprised when electric companies get rid of residential flat rate pricing.

As more smartmeters are deployed it will all be converted to TOU rates. Pass through the changing energy costs instead of charging a fixed rate.

Its already happening with

Its already happening with Natural gas and Water bills in our area. high fixed monthly charges with low energy costs. $30/mo base charge for NG, 37 cents per therm for the gas. The gas company sells the fuel at cost and makes all their profit from the fixed monthly fees. As you said, there is little incentive to conserve energy when your annual cost for fixed monthly fees exceeds your fuel cost.

Don’t be surprised when

Don’t be surprised when electric companies get rid of residential flat rate pricing.

As more smartmeters are deployed it will all be converted to TOU rates. Pass through the changing energy costs instead of charging a fixed rate.

I’ve been on one of the local

I’ve been on one of the local utility’s TOU plans since the spring. I’m saving 15 to 20% monthly by load shifting. However, since the weekday summer peak rate (.33/KWh, ouch!) runs from 2:00 until 7:00 p.m. I’m part of the "duck neck" problem as I recover from the peak. Even more energy efficiency on my part could lighten the "duck neck" load, but it would cost me too much money for resultant savings. The only options I see are shifting the weekday summer peak times by two hours to 4:00 until 9:00 or some sort of "live" rate.

I hear you Bob! My most

I hear you Bob! My most recent gas bill is $8 for fuel and $26 in charges for a total of $34. I probably can afford to pay for electricity to heat my water and home even at the higher cost per BTU when I consider eliminating the monthly gas base charges. I’m waiting for the next system (water or home heat) breakdown to change over. Unfortunately I maintain them, so they’re still going strong. 😉

I’ve been on one of the local

I’ve been on one of the local utility’s TOU plans since the spring. I’m saving 15 to 20% monthly by load shifting. However, since the weekday summer peak rate (.33/KWh, ouch!) runs from 2:00 until 7:00 p.m. I’m part of the “duck neck” problem as I recover from the peak. Even more energy efficiency on my part could lighten the “duck neck” load, but it would cost me too much money for resultant savings. The only options I see are shifting the weekday summer peak times by two hours to 4:00 until 9:00 or some sort of “live” rate.

This NY Times article from 11

This NY Times article from 11/8/15 discusses creative electric power pricing (as in free!) that is happening in Texas now:

http://www.nytimes.com/2015/11/09/business/energy-environment/a-texas-utility-offers-a-nighttime-special-free-electricity.html?emc=edit_th_20151109&nl=todaysheadlines&nlid=55259953

This NY Times article from 11

This NY Times article from 11/8/15 discusses creative electric power pricing (as in free!) that is happening in Texas now:

http://www.nytimes.com/2015/11/09/business/energy-environment/a-texas-utility-offers-a-nighttime-special-free-electricity.html?emc=edit_th_20151109&nl=todaysheadlines&nlid=55259953

Bob wrote: "As more

Bob wrote: "As more smartmeters are deployed it will all be converted to TOU rates. Pass through the changing energy costs instead of charging a fixed rate."

In mid-80’s through early 90’s, I was involved in developing communications protocols that became the basis for ANSI-C12.22/IEEE-1703, the data structure for smart metering (http://bit.ly/1iLNYr6). In particular, the so called "Tucker Tables" (ISO application layer) were designed to support TOU, TOU-demand, real-time pricing, as well as a variety of home automation apps for demand management and other types of smart energy controls. Although we didn’t use the term back then, the "Smart Grid" concept was clearly the impetus for this work.

In network architecture parlance, smart meters serve as the gateway between customer-side data & control networks (the internet of things) and the utility distribution network (data and control). My good friends Rich Tucker and Tim Schoechle were among the visionaries for this aspect of today’s Smart Grid. At the time, we anticipated utilities would soon be moving to time-based pricing structures — certainly by the turn of the century, we thought. I recall being excited about various product development possibilities that would flow from these standards. Well, I’m still waiting. I guess I was naive about the role of politics in state-regulated retail energy tariffs.

@Steve, thanks for posting the NY Times article. I was going to post it here myself (here’s a nicer link: http://nyti.ms/1MTrItz).

Texas is clearly on the leading edge of advanced demand-side programs, but even Ercot’s "free nights" program (by far the most successful TOU plan I’m aware of) has less than 5% uptake. And anyone who saves $40 or $50 a month as quoted in the article (that’s the extreme, not the average) very likely already had a favorable load profile, so the utility gives up this revenue with a relatively little benefit in peak load reduction. That’s the problem with self-selection. But the high churn rate suggests there may be some offsetting revenue. According to the article, almost half of the homes enrolled by 2013 dropped out during the following year. Those are the folks who ended up paying more under the plan.

Since Texas is the largest deregulated market, it will be an interesting test bed for innovative TOU pricing plans. But I suspect it’s going to take at least a decade of fits and starts before regulators and consumers nationwide will begin to move further down the path of smart pricing models. I’m afraid the current trend to shift from variable to fixed charges is what we have to look forward to in the near term.

Bob wrote: “As more

Bob wrote: “As more smartmeters are deployed it will all be converted to TOU rates. Pass through the changing energy costs instead of charging a fixed rate.”

In mid-80’s through early 90’s, I was involved in developing communications protocols that became the basis for ANSI-C12.22/IEEE-1703, the data structure for smart metering (http://bit.ly/1iLNYr6). In particular, the so called “Tucker Tables” (ISO application layer) were designed to support TOU, TOU-demand, real-time pricing, as well as a variety of home automation apps for demand management and other types of smart energy controls. Although we didn’t use the term back then, the “Smart Grid” concept was clearly the impetus for this work.

In network architecture parlance, smart meters serve as the gateway between customer-side data & control networks (the internet of things) and the utility distribution network (data and control). My good friends Rich Tucker and Tim Schoechle were among the visionaries for this aspect of today’s Smart Grid. At the time, we anticipated utilities would soon be moving to time-based pricing structures — certainly by the turn of the century, we thought. I recall being excited about various product development possibilities that would flow from these standards. Well, I’m still waiting. I guess I was naive about the role of politics in state-regulated retail energy tariffs.

@Steve, thanks for posting the NY Times article. I was going to post it here myself (here’s a nicer link: http://nyti.ms/1MTrItz).

Texas is clearly on the leading edge of advanced demand-side programs, but even Ercot’s “free nights” program (by far the most successful TOU plan I’m aware of) has less than 5% uptake. And anyone who saves $40 or $50 a month as quoted in the article (that’s the extreme, not the average) very likely already had a favorable load profile, so the utility gives up this revenue with a relatively little benefit in peak load reduction. That’s the problem with self-selection. But the high churn rate suggests there may be some offsetting revenue. According to the article, almost half of the homes enrolled by 2013 dropped out during the following year. Those are the folks who ended up paying more under the plan.

Since Texas is the largest deregulated market, it will be an interesting test bed for innovative TOU pricing plans. But I suspect it’s going to take at least a decade of fits and starts before regulators and consumers nationwide will begin to move further down the path of smart pricing models. I’m afraid the current trend to shift from variable to fixed charges is what we have to look forward to in the near term.

We are part of the smarthours

We are part of the smarthours program, one of the most successful TOU/VPP programs in the world. Works well for those who choose to participate.

http://www.smarthours.com

Hi Allison: we have multiple

Hi Allison: we have multiple partial solutions already at hand. First, East Coast loads decline significantly after 10PM EST (see the top New England load graph), so using existing low loss high voltage long distance transmission the East Coast has plenty of juice to ship to CA from 7PM PST and later. BTW California can export its excess juice to the East Coast starting late afternoon until sunset nears, cutting the East Coast peak. 2)Significant demand shift at low cost can occur with hot water storage, space heating (the Pacific NW uses ceramic "bricks" to store heat), AC thermal cooling storage, and appliances (dishwasher, washer, dryer) with timers. Sensible TOU pricing will cause this demand time shift to happen automatically. 3)The US currently has 21.5 gigawatts of pumped hydro storage capacity. Here, an existing hydro facility simply pumps water uphill when electricity is inexpensive and in oversupply, then generates hydro electricity when juice is expensive and undersupplied. Efficiencies of 80% are typical, see https://en.wikipedia.org/wiki/Pumped-storage_hydroelectricity Daily wholesale electricity price fluctuations at the buss bar greatly exceed this 20% loss factor. The existing generators simply reverse to pump water uphill, and all hydro generators already have sufficient grid capacity installed. FERC has dozens of applications where operators want to expand existing or construct new pumped hydro storage sites. 4)If/when future battery storage (including electric car batteries, new or used) becomes cheaper than pumped hydro, the market will simply shift to battery storage at lower cost. (One question: why does CA’s load peak rise fully 3+ gigawatts from 2012 to 2020 on the duck curve, when CA’s actual per capita electricity usage has declined fully 40 years in a row? Not obvious).

We are part of the smarthours

We are part of the smarthours program, one of the most successful TOU/VPP programs in the world. Works well for those who choose to participate.

http://www.smarthours.com

Hi Allison: we have multiple

Hi Allison: we have multiple partial solutions already at hand. First, East Coast loads decline significantly after 10PM EST (see the top New England load graph), so using existing low loss high voltage long distance transmission the East Coast has plenty of juice to ship to CA from 7PM PST and later. BTW California can export its excess juice to the East Coast starting late afternoon until sunset nears, cutting the East Coast peak. 2)Significant demand shift at low cost can occur with hot water storage, space heating (the Pacific NW uses ceramic “bricks” to store heat), AC thermal cooling storage, and appliances (dishwasher, washer, dryer) with timers. Sensible TOU pricing will cause this demand time shift to happen automatically. 3)The US currently has 21.5 gigawatts of pumped hydro storage capacity. Here, an existing hydro facility simply pumps water uphill when electricity is inexpensive and in oversupply, then generates hydro electricity when juice is expensive and undersupplied. Efficiencies of 80% are typical, see https://en.wikipedia.org/wiki/Pumped-storage_hydroelectricity Daily wholesale electricity price fluctuations at the buss bar greatly exceed this 20% loss factor. The existing generators simply reverse to pump water uphill, and all hydro generators already have sufficient grid capacity installed. FERC has dozens of applications where operators want to expand existing or construct new pumped hydro storage sites. 4)If/when future battery storage (including electric car batteries, new or used) becomes cheaper than pumped hydro, the market will simply shift to battery storage at lower cost. (One question: why does CA’s load peak rise fully 3+ gigawatts from 2012 to 2020 on the duck curve, when CA’s actual per capita electricity usage has declined fully 40 years in a row? Not obvious).

To my thinking, the issue is

To my thinking, the issue is that we currently purchase "energy" at low cost from an industry that deals in "power." The wholesale electricity market has hourly pricing but utilities basically bill customers monthly, and after the fact. This (barely) functions with a centralized distribution model that is run on fossil fuels ("stored" energy), but seems headed for collapse as more renewable, and intermittent, power sources are added to the grid. As the "Peking" Duck Curve shows, the intersection of intermittent demand and intermittent supply is problematic, unless they can be synchronized.

I agree that both TOU pricing (to provide incentives that align with costs) and storage are required to address the new reality. BTW, California’s utility regulatory board (CPUC) has mandated TOU pricing by 2019 (http://www.greentechmedia.com/articles/read/Breaking-California-Reaches-Compromise-on-Utility-Residential-Rate-Reform).

Regarding energy efficiency and thermal storage, the good news is that with efficient building shells you get thermal storage, along with lower energy consumption. In the short term (i.e. days) due to the building’s time constant; in the long term (seasonal) due to demand reduction (and use of internal gains) to address heating demand, which will be the biggest challenge in a renewable (high solar component) grid. In the future, building shell efficiency stands to be worth a whole lot as it will enable occupants to adjust the space conditioning schedule largely independently of hourly outdoor conditions. By contrast, inefficient building shells require space conditioning that is nearly aligned with hourly outdoor conditions – a big part of the California summer evening ramp is air-conditioning, for example.

I’ve played around with the Duck Curve quite a bit and have it in a presentation that should be available here before long (http://www.norcalsolar.org/events/net-zero-energy-homes-and-passive-house).

Oh, one comment I forgot. I

Oh, one comment I forgot. I’ve been playing with the "Duck Curve" for analyzing daily events, but there is a larger curve containing all the ducks of the year. Even presupposing that the daily ducks are flattened with storage and demand response, the larger "Duck Pond" curve shows an annual load curve that peaks at the middle of summer and in the dead of winter. The winter peak is a particular challenge for solar energy, since it is largely do to a general lack thereof. Here is where building performance can play a critical, and valuable role.

There are current experiments with "Power to Gas," converting summer solar energy to methane, but this is an inefficient process. My prediction is that winter power will become as expensive, or more so, than summer power, as a consequence of both high demand and low supply.

To my thinking, the issue is

To my thinking, the issue is that we currently purchase “energy” at low cost from an industry that deals in “power.” The wholesale electricity market has hourly pricing but utilities basically bill customers monthly, and after the fact. This (barely) functions with a centralized distribution model that is run on fossil fuels (“stored” energy), but seems headed for collapse as more renewable, and intermittent, power sources are added to the grid. As the “Peking” Duck Curve shows, the intersection of intermittent demand and intermittent supply is problematic, unless they can be synchronized.

I agree that both TOU pricing (to provide incentives that align with costs) and storage are required to address the new reality. BTW, California’s utility regulatory board (CPUC) has mandated TOU pricing by 2019 (http://www.greentechmedia.com/articles/read/Breaking-California-Reaches-Compromise-on-Utility-Residential-Rate-Reform).

Regarding energy efficiency and thermal storage, the good news is that with efficient building shells you get thermal storage, along with lower energy consumption. In the short term (i.e. days) due to the building’s time constant; in the long term (seasonal) due to demand reduction (and use of internal gains) to address heating demand, which will be the biggest challenge in a renewable (high solar component) grid. In the future, building shell efficiency stands to be worth a whole lot as it will enable occupants to adjust the space conditioning schedule largely independently of hourly outdoor conditions. By contrast, inefficient building shells require space conditioning that is nearly aligned with hourly outdoor conditions – a big part of the California summer evening ramp is air-conditioning, for example.

I’ve played around with the Duck Curve quite a bit and have it in a presentation that should be available here before long (http://www.norcalsolar.org/events/net-zero-energy-homes-and-passive-house).

Oh, one comment I forgot. I

Oh, one comment I forgot. I’ve been playing with the “Duck Curve” for analyzing daily events, but there is a larger curve containing all the ducks of the year. Even presupposing that the daily ducks are flattened with storage and demand response, the larger “Duck Pond” curve shows an annual load curve that peaks at the middle of summer and in the dead of winter. The winter peak is a particular challenge for solar energy, since it is largely do to a general lack thereof. Here is where building performance can play a critical, and valuable role.

There are current experiments with “Power to Gas,” converting summer solar energy to methane, but this is an inefficient process. My prediction is that winter power will become as expensive, or more so, than summer power, as a consequence of both high demand and low supply.

Graham wrote: "the issue

Graham wrote: "the issue is that we currently purchase "energy" at low cost from an industry that deals in "power." The wholesale electricity market has hourly pricing but utilities basically bill customers monthly"

Utilities by and large don’t have a problem with this. From a revenue perspective, they get their money one way or another. Short-term increases to wholesale power costs are recovered through power adjustment adders.

The disconnect between utility wholesale and retail pricing structures (for residential) is, and always has been a an issue of fairness. With energy-only tariffs, rural customers are subsidized by urban customers. Snowbirds are subsidized by year-round residents. Energy efficient homes are subsidized by energy hogs. The rapid growth of solar (especially what happened in Hawaii) has brought the fairness issue to a head, but I think it’s unfair to single out a a single class to go after the fairness issue.

Regarding CPUC’s mandate for TOU by 2019… this will eventually spread to other states but I’m not holding my breath. California’s regulatory actions are decades ahead of most states. One thing that’s interesting is that this new rate policy disallows high fixed charges in favor or minimum billing. This keeps the kWh rate higher (compared to what happens with a high fixed charge), thus retaining the incentive to conserve energy. OTOH, the EE folks were not happy with the reduction in the number of rate tiers. And of course, the movement to TOU depreciates the value of EE investments. So it’s a mixed bag.

Graham wrote: “the issue

Graham wrote: “the issue is that we currently purchase “energy” at low cost from an industry that deals in “power.” The wholesale electricity market has hourly pricing but utilities basically bill customers monthly”

Utilities by and large don’t have a problem with this. From a revenue perspective, they get their money one way or another. Short-term increases to wholesale power costs are recovered through power adjustment adders.

The disconnect between utility wholesale and retail pricing structures (for residential) is, and always has been a an issue of fairness. With energy-only tariffs, rural customers are subsidized by urban customers. Snowbirds are subsidized by year-round residents. Energy efficient homes are subsidized by energy hogs. The rapid growth of solar (especially what happened in Hawaii) has brought the fairness issue to a head, but I think it’s unfair to single out a a single class to go after the fairness issue.

Regarding CPUC’s mandate for TOU by 2019… this will eventually spread to other states but I’m not holding my breath. California’s regulatory actions are decades ahead of most states. One thing that’s interesting is that this new rate policy disallows high fixed charges in favor or minimum billing. This keeps the kWh rate higher (compared to what happens with a high fixed charge), thus retaining the incentive to conserve energy. OTOH, the EE folks were not happy with the reduction in the number of rate tiers. And of course, the movement to TOU depreciates the value of EE investments. So it’s a mixed bag.

Intersting idea, replace the

Intersting idea, replace the fixed monthly service charge with a minimum bill. Do something like 1st 300KWH $40/mo, 10 cents per KWH thereafter? Instead of $15/mo service charge and 10 cents per KWH?

That’s right Bob. Using the

That’s right Bob. Using the number in your example, equivalency would actually be at 250 kWh. What CPUC is trying to avoid is $40/mo fixed + 7 cents. If the average customer uses 833 kWh/mo, then all of these would be considered revenue neutral. But the latter approach creates winners and losers. Perversely, the losers are the smallest homes and those who conserve or install PV.

I can’t speak to how the

I can’t speak to how the utilities feel about the matter (I suspect it varies widely between decoupled, regulated and unregulated, as well as by region and fuel mix) but there is a tremendous cost to the electrical grid from maintaining ramping capacity for peak load, and solar stands to make it worse, which is the point of the Duck Curve.

My point is that demand response and storage stand to be quite valuable as the grid comes to rely more and more on inherently intermittent renewable energy. Current estimates I have seen on the cost of peak load state that 10% of the US peak electrical load occurs in less than 1% of the year, and that a 10% peak load reduction is worth $8-28 billion per year. This issue will become more pressing in future.

In California, particularly in the south, there are all manner of demand response programs already in place (remote deactivation of residential air-conditioners, for example) which suggests that peak load is a concern for the utilities there.

Intersting idea, replace the

Intersting idea, replace the fixed monthly service charge with a minimum bill. Do something like 1st 300KWH $40/mo, 10 cents per KWH thereafter? Instead of $15/mo service charge and 10 cents per KWH?

That’s right Bob. Using the

That’s right Bob. Using the number in your example, equivalency would actually be at 250 kWh. What CPUC is trying to avoid is $40/mo fixed + 7 cents. If the average customer uses 833 kWh/mo, then all of these would be considered revenue neutral. But the latter approach creates winners and losers. Perversely, the losers are the smallest homes and those who conserve or install PV.

I can’t speak to how the

I can’t speak to how the utilities feel about the matter (I suspect it varies widely between decoupled, regulated and unregulated, as well as by region and fuel mix) but there is a tremendous cost to the electrical grid from maintaining ramping capacity for peak load, and solar stands to make it worse, which is the point of the Duck Curve.

My point is that demand response and storage stand to be quite valuable as the grid comes to rely more and more on inherently intermittent renewable energy. Current estimates I have seen on the cost of peak load state that 10% of the US peak electrical load occurs in less than 1% of the year, and that a 10% peak load reduction is worth $8-28 billion per year. This issue will become more pressing in future.

In California, particularly in the south, there are all manner of demand response programs already in place (remote deactivation of residential air-conditioners, for example) which suggests that peak load is a concern for the utilities there.